Argosy Private Equity News

Keep up with the latest updates regarding our team and portfolio.

2025 Year In Review

Momentum Building, Value Creating: Positioning for Sustained Growth in 2026 1

13

New Investments

2

Exits Completed

3

New Team Members

7

Funds

“The best way to predict the future is to create it” – Peter Drucker

As we look back on 2025, we are thankful for a year of steady progress, resilience, and growing momentum. In a dynamic M&A market, our team remained active and disciplined. We are grateful for the opportunity to continue partnering with lower middle market companies, deploying capital across both platform and add-on investments.

We closed 1 new platform investment, Warehouse Anywhere, completing Fund VI’s deployment, and executed 12 add-on acquisitions across our portfolio. We also completed 2 exits, including the sale of Groome Industrial Service Group, which generated a meaningful distribution to limited partners despite a challenging exit environment.

Operational value creation continued to be a central part of our approach. Through VAMTM, our value creation process, we partnered with management teams on operational initiatives across the portfolio. We also grew the Argosy team in 2025, adding three new professionals. The firm now consists of 24 team members, including an eight-person Operating team.

Looking ahead to 2026, we are deeply appreciative of the ongoing trust and collaboration from our management teams, business partners, and limited partners. We enter 2026 with optimism and excitement for the opportunities ahead.

1 Platform Acquisition

In May 2025, Argosy Private Equity made its final Fund VI platform investment in Warehouse Anywhere, a Lakewood, CO–based tech-enabled BPO provider that manages self-storage solutions for large corporate clients through proprietary technology.

12 Add-On Acquisitions

2025 marked a dynamic chapter for Argosy Private Equity, as the investment team completed a remarkable 12 add-on acquisitions spanning multiple platforms. The deals were executed at attractive valuations, driving value creation and unlocking new growth opportunities across the portfolio. This flurry of activity not only showcased Argosy’s disciplined approach but also underscored the team’s ability to seize market opportunities and deliver meaningful results for investors and partners alike.

Exit Activity

In January 2025, Argosy Private Equity exited its investment in Joliet Electric Motors, a manufacturer and distributor of large electric motors serving the oil and gas drilling market, through a sale to Hitachi, Ltd. During Argosy’s ownership, Joliet navigated industry challenges by pivoting toward electrically powered fracking systems and expanding its repair business into mining, dredging, and marine end markets.

In August 2025, Argosy Private Equity exited its investment in Groome Industrial Service Group, a provider of industrial cleaning and maintenance services to customers in the natural gas-fired power generation, refinery, manufacturing, construction, marine, and aviation industries.

Key initiatives included expanding Groome’s geographic footprint, diversifying service offerings, and pursuing strategic acquisitions, including ExPro, Blasting Solutions, and W-S Companies. These efforts collectively enhanced Groome’s market position and operational capabilities and contributed to growing EBITDA over 900% during Argosy’s hold period.

Upcoming Exits

We continue to work closely with management teams to execute their business plans and drive operational initiatives through VAM™. As always, we continue to evaluate additional exit opportunities as appropriate to help maximize returns to our investors.

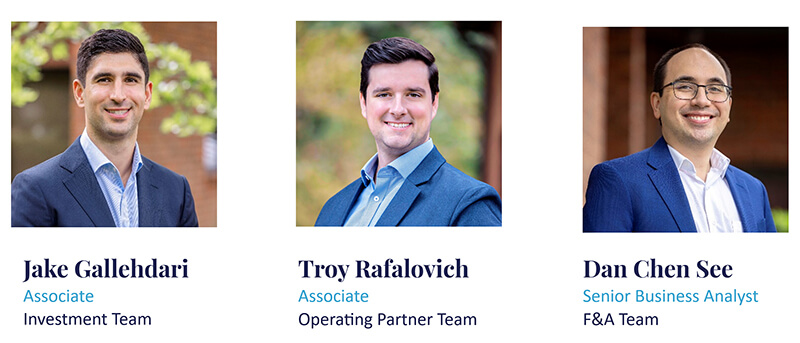

New Additions to the Team

We welcomed 3 new team members, including one addition to the Investment Team, one addition to the Operating Partner Team, and one addition to the Finance and Administration team.

We are excited to continue expanding our Investment Team. We are actively seeking a Pre-MBA Associate to join our Wayne, PA office and support our deal execution and portfolio initiatives in this next chapter. Learn more here: Argosy Private Equity Pre-MBA Associate

Continued Focus on Partnership and Collaboration

Driving growth through collaboration has always been our focus, and 2025 was no exception. This year, we strengthened our partnerships through strategic deep dives at our 11th Annual CEO Summit at Nemacolin and the CFO Summit in Philadelphia.

2025 VAM™ Initiatives

At Argosy, we continue to refine our value creation process, (VAM™), to drive operational improvement and sustainable growth. In 2025, we added new tools, including:

- Exit Readiness & Value Drivers

- Freight & Logistics

- Sales & Marketing Playbook

- Lean IT & AI

- Customer Service Excellence

We enhanced portfolio monitoring through ArgoSight™. Once fully implemented, the investment team will be able to use this data to pinpoint opportunities across the portfolio to improve operations and profitability. Additionally, we advanced selective technology initiatives, many of them AI-powered, focused on improving operational efficiency and scalable growth within Argosy and across the portfolio.

We also expanded our group purchasing and insurance initiatives, delivering measurable cost savings and, identifying additional cost-saving opportunities. The operating team also hosted several collaborative Summits and webinars to encourage peer learning and development. Supported by our VCIO cybersecurity program and tracked through our Value Creation Scorecard, these efforts continue to drive operational performance and value creation.

VAM™ remains central to helping management teams navigate complexity as they grow and professionalize their businesses.

In the News & Community

We are proud to have been named a Top 50 Middle Market PE Firm by Grady Campbell for the fourth year in a row.2 We are grateful to our team, partners, and portfolio for another strong year.

The CEO and Sales Manager of Mr. Splash, an Argosy portfolio company joined Thanasis Antetokounmpo on his podcast Thanalysis to officially announce the Splash Squad partnership — teaming up with NBA stars Thanasis & Giannis Antetokounmpo and Michael Carter-Williams.

Below is a selection of associations and philanthropic organizations where our teammates are actively engaged, making a meaningful impact.

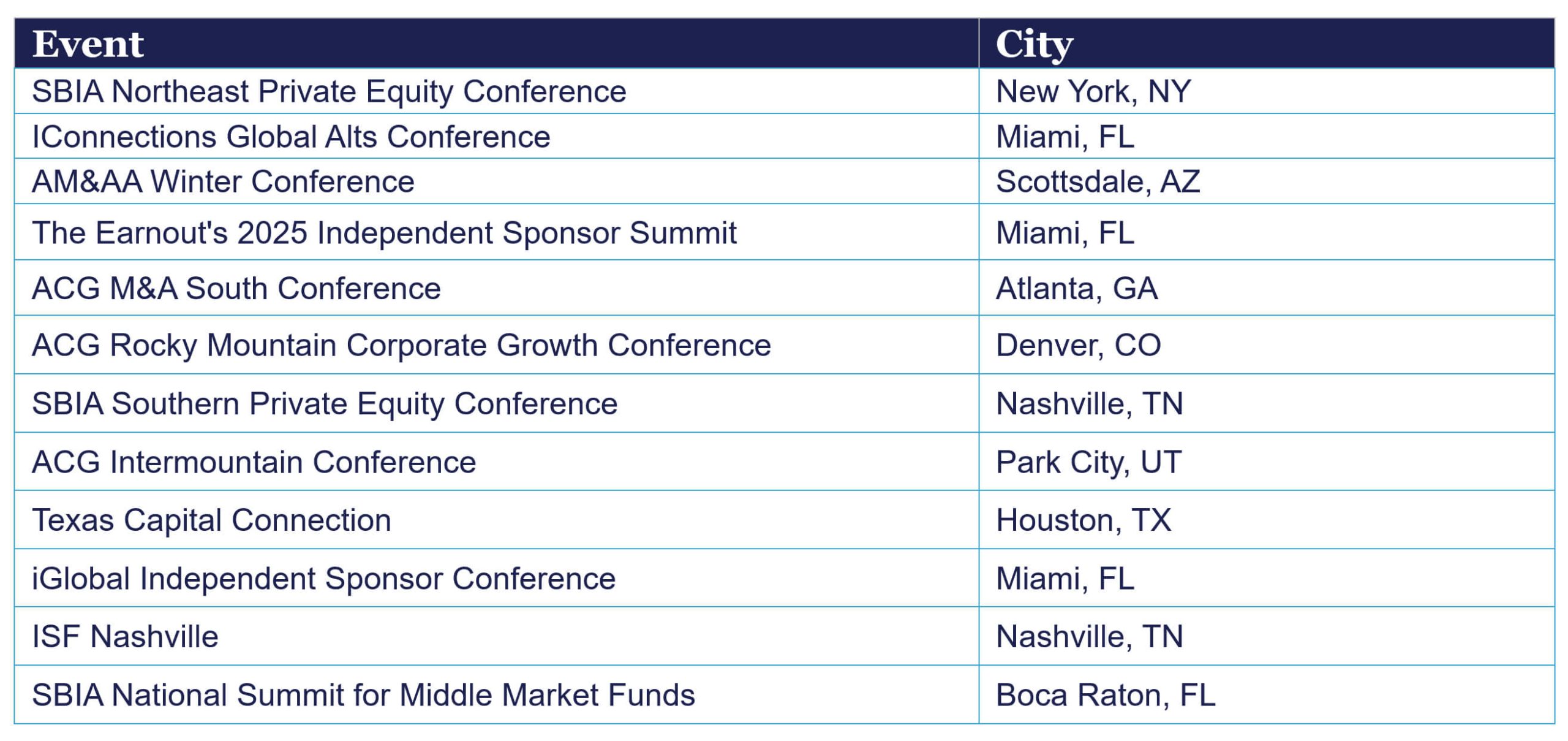

Be on the lookout for Argosy at these upcoming events:

We are energized for the future and look forward to achieving new milestones together in 2026!

Thank you to all our partners for a great 2025!

1 All statistics as of December 31, 2025. Past performance is not indicative of future results, which may vary.

2 These awards are the opinion of the party conferring the award and not of Argosy. Argosy submitted a nomination, and once selected, paid a publishing and copyright fee to promote these awards. There can be no assurance that other providers or surveys would reach the same conclusion as the foregoing.