Argosy Strategic Partners News

Keep up with the latest updates regarding our team and portfolio.

A Tale of Two Secondary Markets: The Case for Lower Middle Market Transactions

Key Takeaways

- Including secondaries in a portfolio can offer enhanced diversification, j-curve mitigation, a reduction of blind pool risk and an accelerated return of capital

- We believe investing in the smaller transaction sizes available in the lower middle market for secondaries offers benefits to investors including more favorable pricing dynamics resulting in lower risk and improved pricing

- Argosy Strategic Partners (“ASP”) is uniquely positioned to compete in the lower middle market due to:

- Deep experience originating, valuing and executing secondary transactions compared to lower middle market competition

- The support of Argosy Capital’s finance and administrative infrastructure and asset divisions with expertise in private equity, real estate, credit and healthcare

The Case for Secondaries

Traditional benefits of secondaries, many with an immediate impact, can offer investors attractive risk-adjusted returns. As the secondary market continues to reach record levels, we believe that investing in secondaries can enhance an alternatives portfolio, regardless of transaction size.

- J-Curve Mitigation By investing in a portfolio of mature funds, investors receive distributions earlier in the fund life, mitigating the impact that management fees and fund expenses have on contributed capital early in the life of a fund1

- Immediate Diversification As most often seen in LP transactions, investors gain access to a portfolio that is allocated across vintages, strategies, and GPs.1,2

- Limited Blind Pool Risk Secondary LP investments are generally made in funds that are partially or fully invested, giving insight into the makeup of underlying portfolios.1

- Shorter Duration Secondary vehicles typically take less time than traditional alternative strategies to reach distribution targets, thus having shorter fund lives than traditional private equity funds. According to Cambridge Associates, secondary funds typically take less time than other PE strategies to reach a distributed to paid-in capital (DPI) multiple of 1.0x, often with a 0.4x DPI in the first five years, which is uncommon for other PE strategies that generally take longer to distribute capital back to LPs.1

- Capital Efficiency LPs of secondary funds typically have lower net exposure (the difference between capital called and distributed at any given point in a fund’s life) relative to LPs of other alternative investment strategies due to earlier distributions. Secondary funds provide unique avenues for liquidity in an asset class known for its illiquidity.1

The Case for Small Transaction Investing in the Lower Middle Market

The benefits of investing in the secondary market are enhanced by investing in the smaller transaction sizes offered by the lower middle market. The market dynamics in smaller transactions are more favorable for buyers than larger transactions which represent the vast majority of transaction volume in the secondary market.

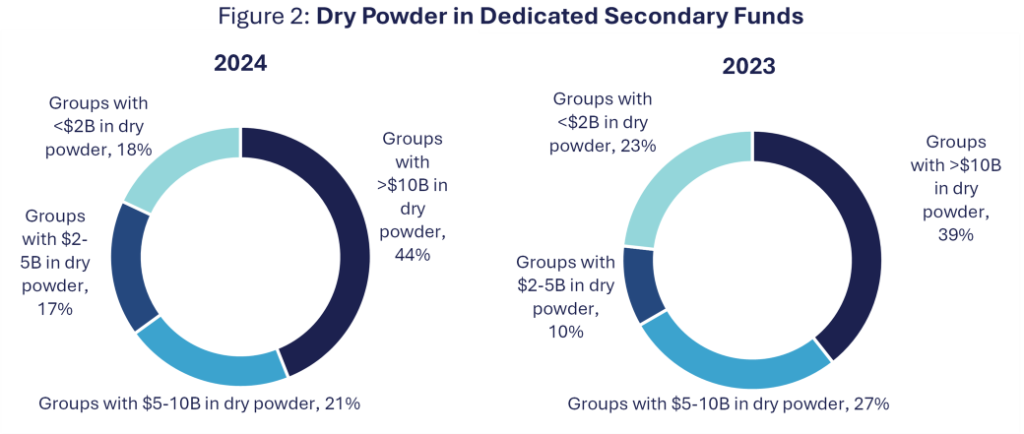

- Lower Dry Powder Overhang Dry powder is concentrated at the larger end of the market. In the lower middle market, there are fewer professionally managed funds and less capital available to compete for smaller transactions. Since 2023, the concentration of funds and capital raised has been at the larger end of the market. We believe the deal flow relative to available capital is greater with smaller transaction sizes in the lower middle market, allowing buyers to negotiate better pricing and other terms and be more flexible with deployment patterns based on market dynamics and transaction quality.1

Source: Campbell Lutyens: FY2024 Secondary Market Overview. Percentages may not sum to 100% due to rounding.

- Seller Profile Sellers at the larger end of the market are typically institutional investors looking to sell as a part of their continuous portfolio management. On the smaller end, sellers more often include individuals and family offices driven by their need for cash, accepting larger discounts for immediate liquidity.2

- Operating Inefficiencies for Alpha Generation Both the sophistication and the resources of larger sellers, combined with focus by intermediaries, translate to more efficient transaction processes. Buyer and seller relationships on the larger end are highly structured through investment banks executing professionally managed auction processes, while they are more relationship-driven on the smaller end with less attention from intermediaries, offering more pricing variability. Less structured smaller secondary transactions often involve an inconsistent pool of buyers, ranging from individuals to family offices to small fund-of-funds, and are transacted within one to two quarters while larger transactions can take multiple quarters to market, negotiate and close.2

With fewer professionally managed funds competing, unique seller profiles, and the transaction inefficiencies observed in smaller secondary transactions, buyers are able to generate more favorable pricing and terms and can have better performance than the larger end of the market.

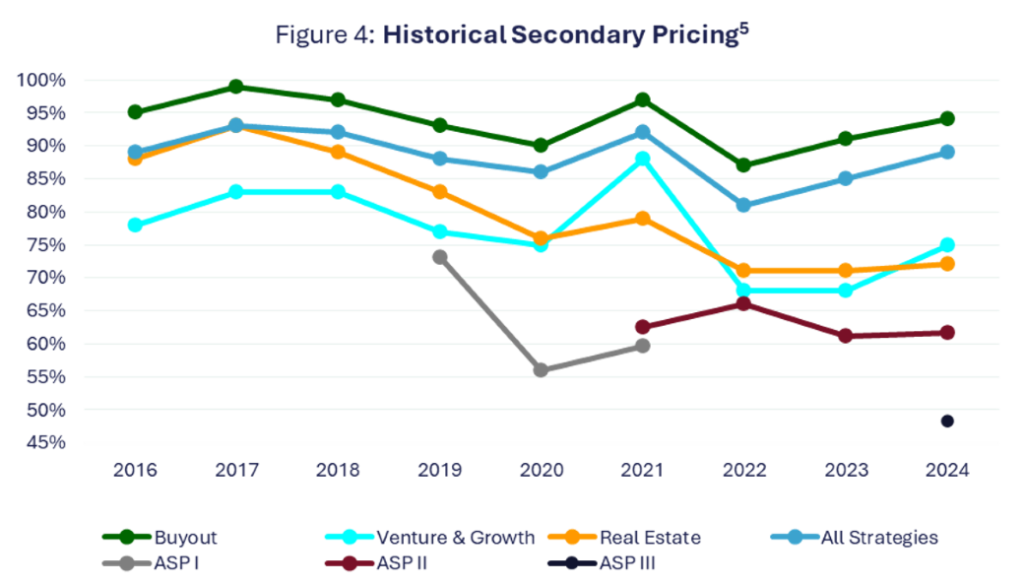

- Pricing The more robust discounts observed in smaller transactions are reflected below via ASP I and ASP II’s average pricing. In our experience, sellers on the smaller end have more urgent needs for liquidity and are more flexible at the price at which they sell. This is evident in ASP’s track record, which typically has lower average pricing versus the broader secondary market.1, 4

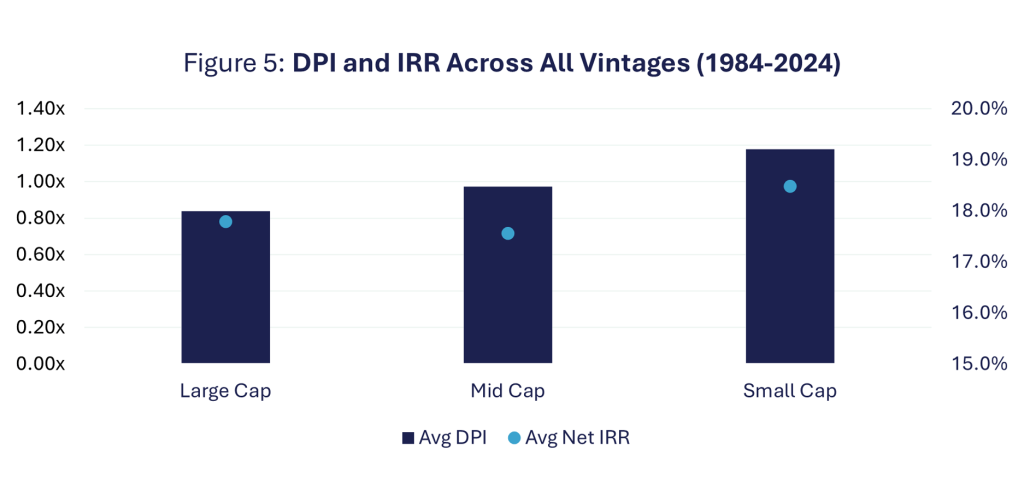

- Performance DPI is generally higher for small-cap secondary funds vs mid-cap and large-cap funds. Favorable pricing for and more flexible terms for buyers acquiring smaller LP interests in the lower middle market can result in outperformance.6

Source: Preqin: Secondaries returns for fund vintages 1984-2024.

Note Small-Cap denotes funds <$250MM; Mid-Cap between $250MM-1B; Large-Cap >$1B.

ASP is Positioned to Perform in the Lower Middle Market for Secondary Transactions

- Experienced in Secondaries The ASP team has individually worked on over ~500 transactions with over 150 GPs and has relationships with over 60 intermediaries. Our Partners have worked together in the past, amassing experiences in secondaries prior to building ASP. As the secondary market continues to hit record-breaking volumes, fewer professionals compete in the lower middle market as talent is attracted to larger funds.

- Broader Argosy Capital Strength ASP has the benefit of utilizing Argosy Capital’s infrastructure and professionals which allows us to remain focused on the smaller transactions without the pressure of increasing fund size and to access the investment and fund expertise of private equity, real estate, credit and healthcare.

About ASP

Argosy Strategic Partners acquires limited partnership interests in buyout, venture capital, growth, real estate, credit and other private investment funds on a secondary basis and, on a more limited basis, makes secondary direct company investments and invests in other illiquid assets. ASP seeks to capitalize on persistent inefficiencies in the lower middle market where we believe there are fewer fund competitors and where speed and surety of close are often higher priorities relative to maximizing price.

Our Team

Please click here to see important Disclaimers and Certain Risks and Limitations of Investing in ASP: Disclaimers.

For more information, please contact one of the following:

Sarah Busch, Principal, Investor Relations

Caroline Kirwin, Partner, ASP

Chris Kim, Managing Partner, ASP

- Cambridge Associates: Streamlined Private Investing: Uncovering Growth in Secondaries

- J.P. Morgan Asset Management: The Growing Opportunity in Private Equity Secondaries and Co-Investments

- Coller Capital: Dynamics in the Secondaries Market

- GCM Grosvenor: The Secondaries Surge: Reflections on 2024 and the Road Ahead for 2025

- Jefferies Global Secondary Market Review 2023; ASP figures exclude primaries and directs and are based on discounts where available for investments closed through 9.30.24

- Seine Capital: DPI is the New IRR

PLEASE SEE “CERTAIN RISKS AND LIMITATIONS OF INVESTING IN ASP” IN THE LINK: Disclaimers.